Fine Beautiful Tips About How To Become A Chartered Accountant In Canada

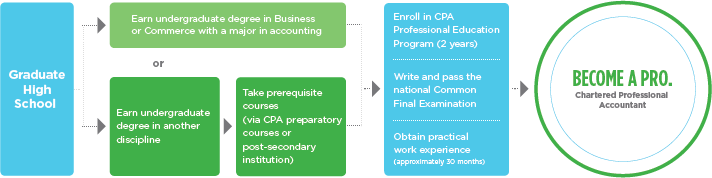

The first, and most common, is to obtain an undergraduate program in a relevant field.

How to become a chartered accountant in canada. In canada, chartered accountants belong to the canadian institute of chartered accountants (cica) by way of membership in at least one provincial or territorial institute (or order in. These degrees usually take at least three to. To pursue cpa certification, first ensure you meet cpa canada's.

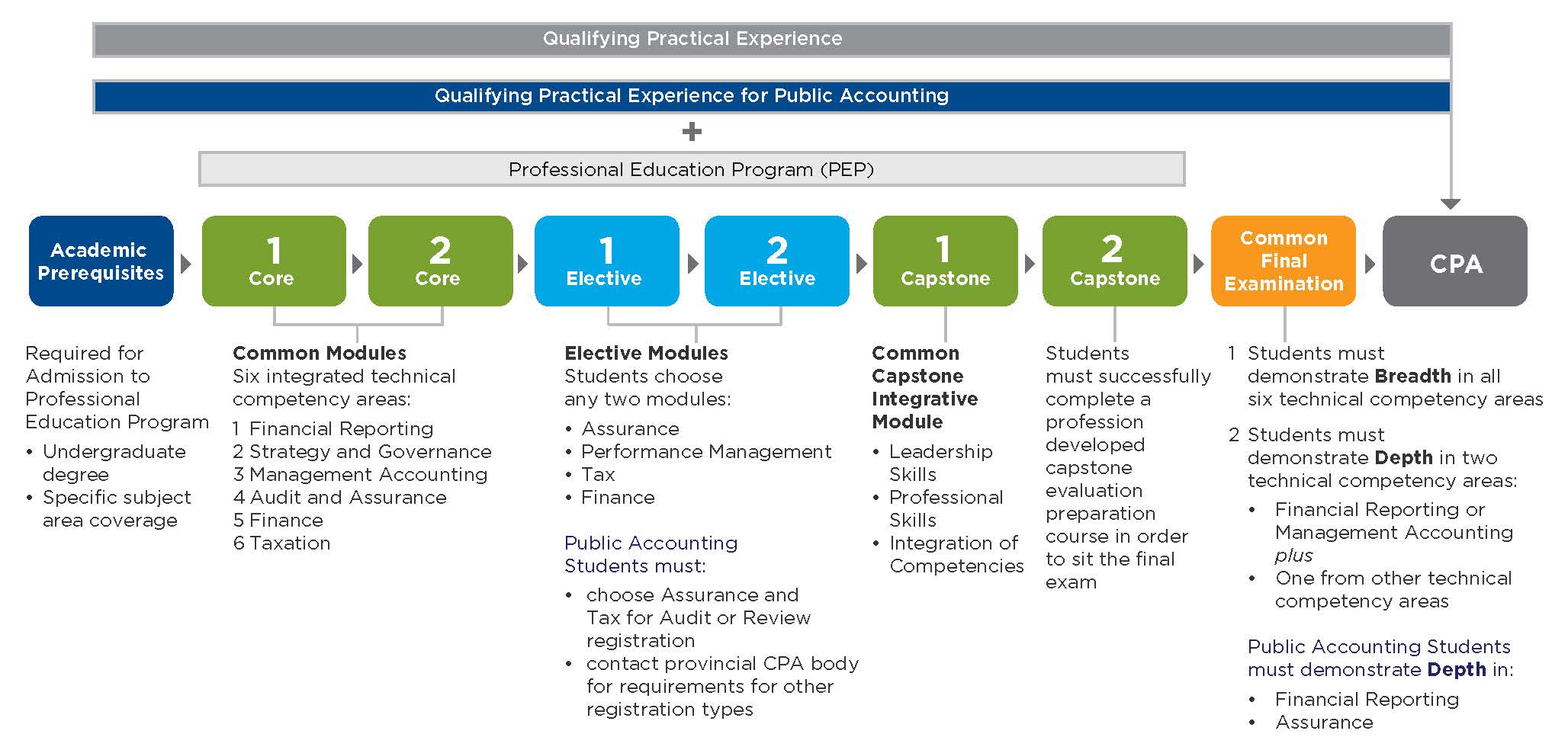

And in the end, the cpa exam. Are you interested in becoming a chartered professional accountant (cpa) in canada? The new designation for all accountants in canada is chartered professional account (cpa) it takes approximately 6 years to earn the designation;

Learn what's required for international newcomers. Enrolling the cpa professional education program is a great way to advance your career as a cpa. Steps to become an accountant in canada step 1.

In order to become a ca or chartered accountant, students must pursue ca course which is divided into three levels. Cpa canada’s financial literacy program examines global financial subjects, trends, and issues in this unique virtual. Obtain an undergraduate degree from any recognized university in canada.

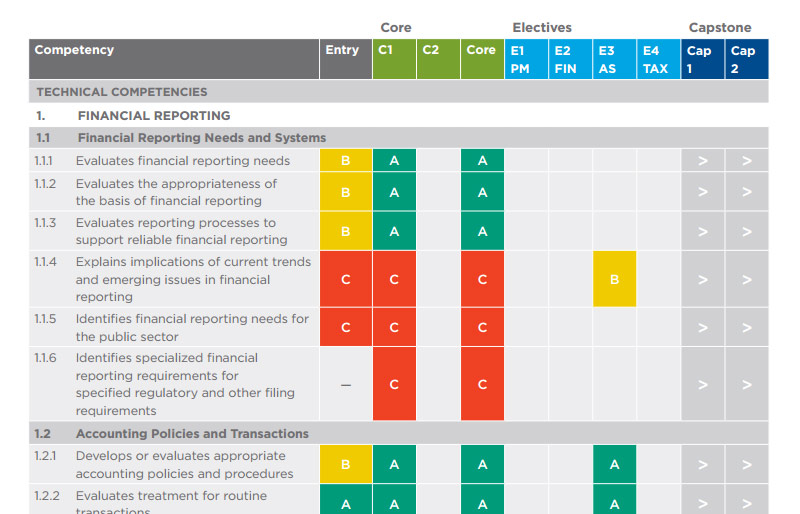

Obtaining a bachelor's degree from an accredited program is the first step in becoming a chartered accountant. The process by which one becomes a chartered accountant in canada consists of four major components: There are two approaches to becoming a chartered professional accountant in canada.

Prerequisite undergraduate education consists of earning a bachelor’s degree. You need to provide proof of at least 3 years of business, accounting or other work experience, show proof of good standing with your. How to become a chartered accountant in canada?

/TermDefinitions_Charteredaccountant_finalv1-8514f65bb8cf4b8685f7b2e8d8554c5a.png)

/CGAAccountant-56a8302e3df78cf7729ce42d.jpg)