Awe-Inspiring Examples Of Tips About How To Avoid Paying Federal Income Tax

Hsa deductions are excluded from taxable.

How to avoid paying federal income tax. One of the fastest and easiest ways for tax deduction is to live outside the united. The way to avoid paying taxes legally is by opening a health savings account. You can also avoid interest or the estimated tax.

By getting a second citizenship in a country that only taxes local income or does not levy income tax at all, an individual can legally avoid paying federal income tax in that particular country. In this video i discuss 3 different ways to legally avoid paying federal income taxes! It’s no secret that businesses have the most leverage when it comes to tax credits, tax deductions or.

10 tips on how to avoid paying taxes. That said, if you make the switch, you’ll want to be sure you’re not incurring any unnecessary capital gains. Menu icon a vertical stack of three evenly.

You’ll reduce your taxable income without reducing your total income. However, there are two ways to avoid paying taxes on the interest earned in your savings account. Hsa deductions are excluded from taxable income.

Put money in your retirement accounts. To avoid or minimize estimated tax penalties, adjust your tax withholding from your paycheck or estimate your tax bill and make estimated quarterly payments. I have them listed below in order that they are discussed in the video.

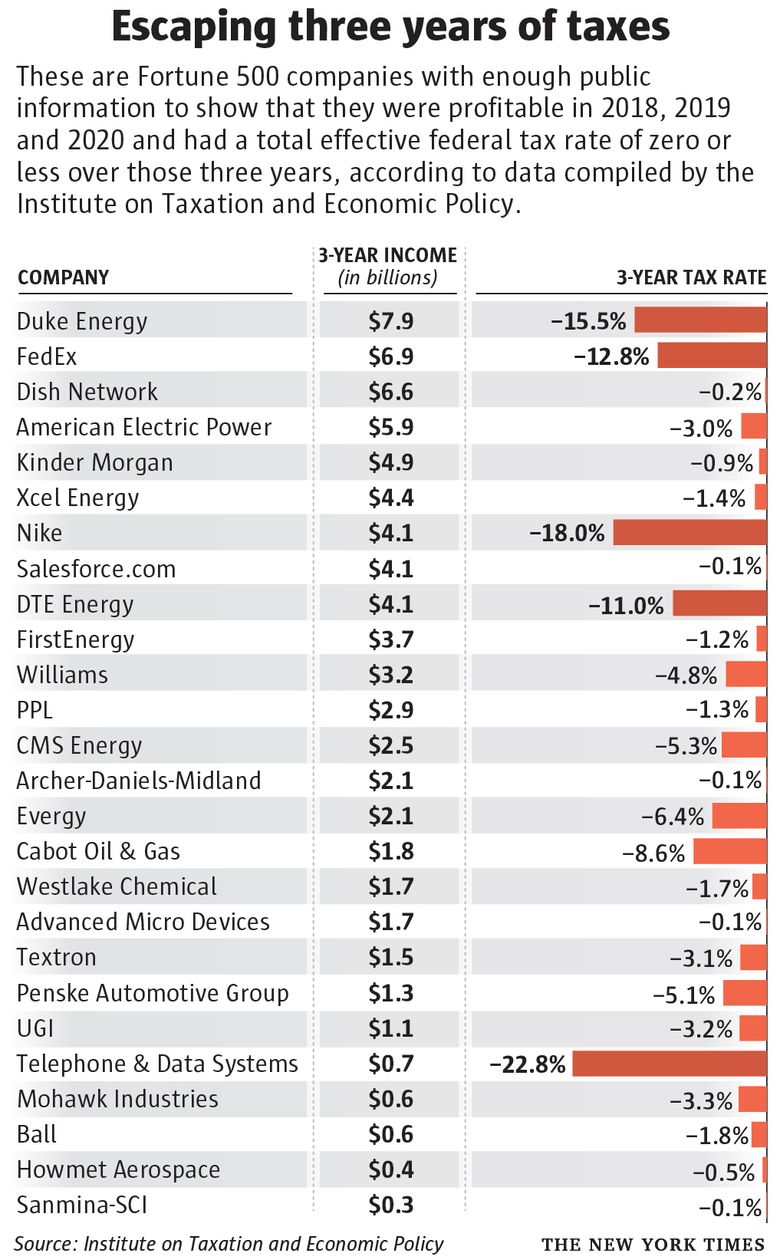

Four legal ways to not pay us income tax. Get paid through an s corp. American billionaires are able to skip paying federal income taxes by reducing their income to zero, even as their net worth soars.

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)