Stunning Tips About How To Sell An Endowment Policy

You might want to sell if your statement shows it’s.

How to sell an endowment policy. How selling your endowment works wait until it matures. Endowment exchange buys over existing endowment policies at. Overall, the selling process works as follows:

Endowment policies are usually sold as an investment. Endowment life insurance is a specialized insurance product that's often dressed up as a college savings plan. Either contact a broker or approach your existing insurance company for quotes.

If you have a with profits endowment or whole of life policy, you can get details of companies that buy and sell these by calling the association of policy market makers on. If you have an endowment policy that you’ve decided to sell, consider selling it to endowment exchange. There are three main ways of selling endowments.

Just like selling cars or hdb flats, the ownership can be legally transferred. Some endowment policies offer cash benefit options, which are payable at regular intervals during the term of the policy. It provides dual functionality of life coverage along with savings.

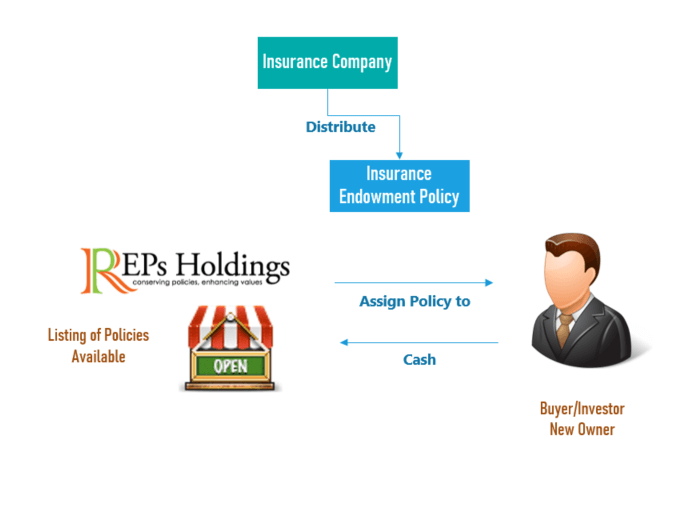

An endowment sale is a transaction that takes place when an endowment policyholder decides to sell a policy. When you sell your endowment plan, your policy is transferred to the party you sold it to. In this article, fundmylife discusses the pros and cons of selling your endowment.

This transfer of policy ownership will be done at the respective insurers’ customer service centre where the. Withdraw cash from your endowment policy. How selling your endowment works if you hold an endowment policy, you can sell it to a third party before its maturity date.

/GettyImages-475702616-3d8d1ec251704afbbd1a3f9580d63bcb.jpg)