Brilliant Info About How To Prevent Credit Card Debt

Credit card debt results when a client of a credit card company purchases an item or service through the card system.

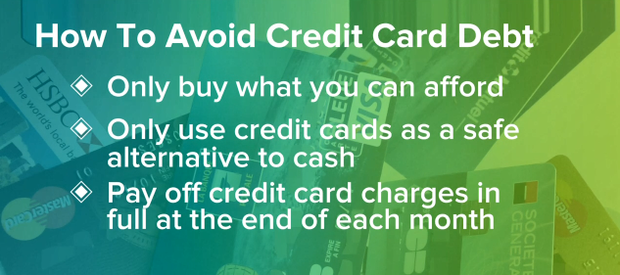

How to prevent credit card debt. Consumer credit counseling programs can allow you to get caught up on payments if you are only a month or two behind. To help you avoid the financial predicament so many americans find themselves in these days, here are 7 tips on how to avoid credit card debt: How to avoid 10 habits of credit card debt:

If you’re behind on your payments or have lost your source of income, speaking with your credit card provider is an important first step in managing your debt. As you work to get rid of your credit card debt, it's also important to take steps to avoid taking on more of it in the future. Prevent credit card debt by establishing in advance how much you can charge each month.

The growing interest rates might pile up and become a problematic payment. Maybe you ditched debt, but history can repeat if you don’t unpack the motivations that. How to avoid credit card debt method 1 practicing financial responsibility.

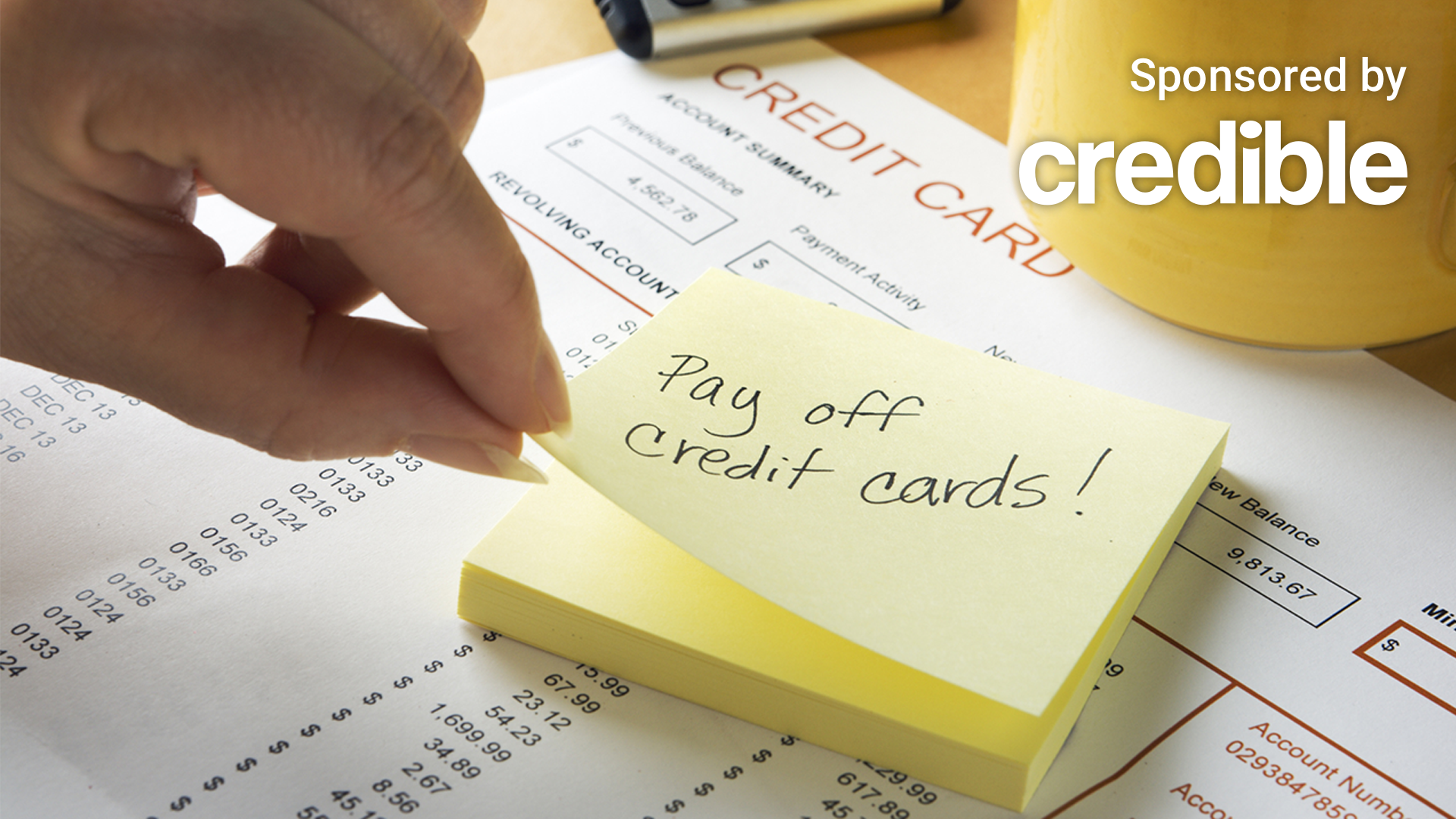

If you decide to tackle your debt on your own, one option is called the debt avalanche. Paying on time will help keep your interest rates low and may even improve. Using your credit card must figure into your budget,.

You pay off your credit card balances from the highest apr to the lowest apr. If you are tired of the inconvenience of paying cash, but don’t want to. Understand all the terms before opening a new credit card.

To avoid going into credit card debt, you first need to make sure that you have a safety net in place. Tips to avoid credit card debt. 8 tactics to break the credit card debt cycle 1.

/exhausted-businessman-running-away-from-credit-card-170886185-5770a3ff3df78cb62ce6521c.jpg)