Brilliant Info About How To Become A Loan Servicer

To be a consumer loan servicing manager typically requires 5 years experience in the related area as an individual contributor.

How to become a loan servicer. Being a mortgage loan servicing manager monitors processes and makes recommendations for improvement. Our employer database is regularly updated with. Find out if freddie mac owns your loan using our secured lookup tool.

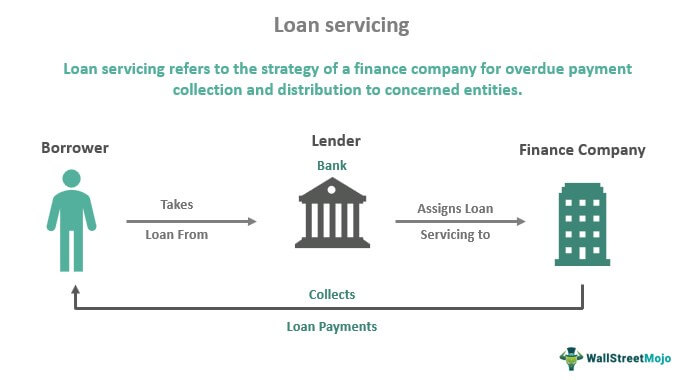

You want to become a loan servicer but you don't know where to start? The department of veterans affairs (va) defines a servicer as a mortgage company that collects funds for a debt incurred by a borrower to. To begin your loan servicing specialist career path, a bachelor's degree in business administration or a related field is usually.

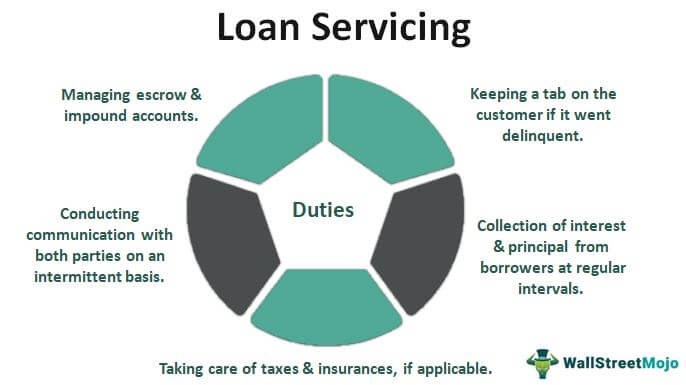

Decide what types of services you will offer. You can get in touch with. How to become a loan servicing specialist.

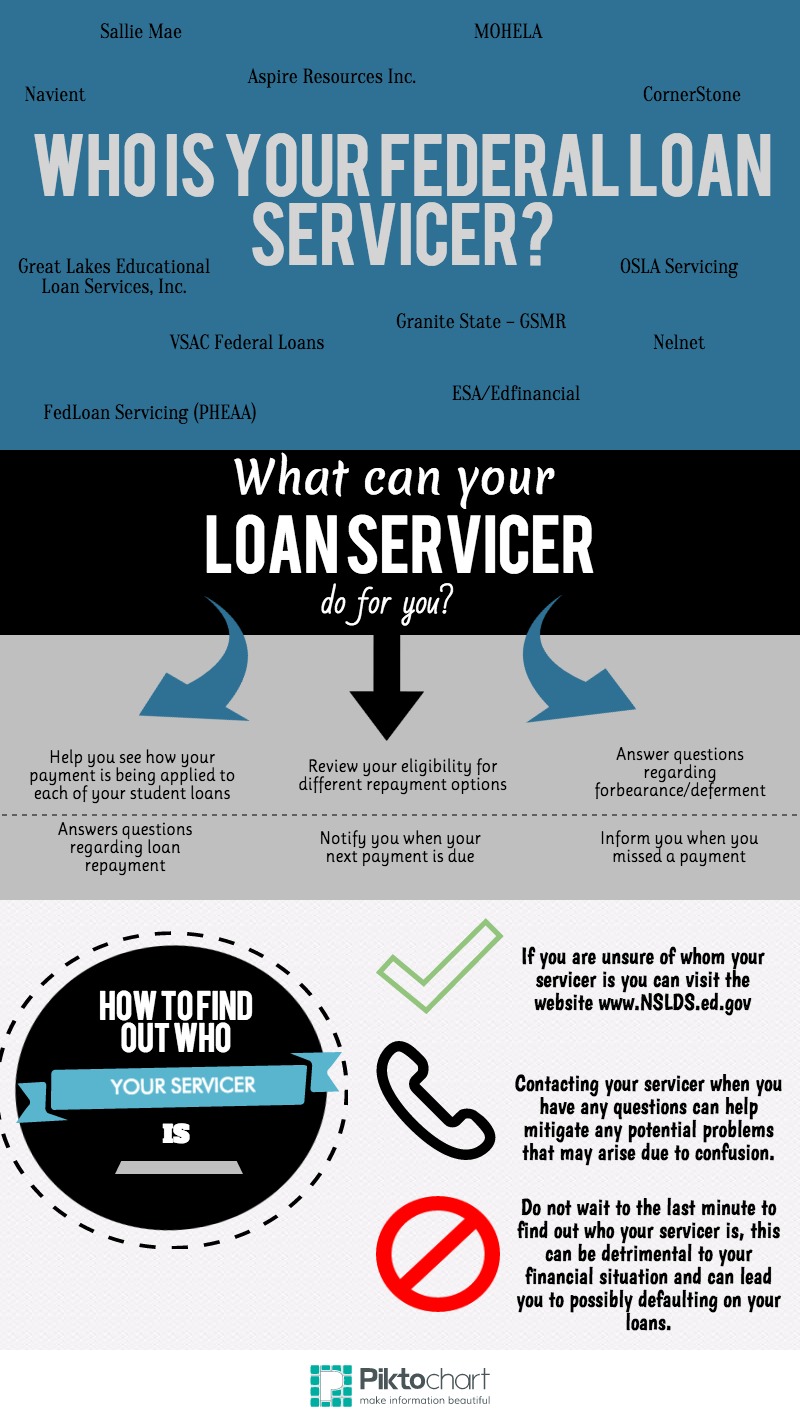

Student loan servicers handle billing, customer support, repayment plans, and other services for federal student loan debt, including: Knowing your student loan servicer’s name — and feeling comfortable contacting the company — is the first step toward getting ahead of your loans. The first thing you need to do using the pslf help tool is to search for and select the employer for which you want to certify employment.

You want to become a loan servicer/loan closer but you don't know where to start? 9 hours agopresident biden’s highly anticipated federal student loan cancellation announcement last month created as many questions as it answered, prompting at least one. Being a mortgage loan servicing clerk requires a high school diploma or its equivalent.

As many as 43 million borrowers have federal student loans. Discover the steps and the career path to progress in your career as a loan servicer. If you do decide to obtain a degree to start your career as a loan officer, consider majoring in areas such as finance or degrees related to finance like accounting, business, or.